Blog

Money Tipps Blog

Looking for a way to invest smarter and save big money from not paying financial advisor fees? Looking for the best money tips, Financial tips, saving tips, or investing tips?

Look no further than Money Tipps Blog, the ultimate resource for millennials who want to take control of their finances and build a brighter financial future.

With Money Tipps, you can become your own financial advisor by learning and educating yourself about the ins and outs of investing rather than needing a financial adviser, we give you the tools to educate and empower your own financial knowledge.

Our expert team provides valuable tips, tricks, and teachings to help you get more from your money.

But that's not all - we also offer the guidance of a dedicated money coach, who can help you navigate difficult financial decisions and gain the confidence to make the best investment choices for your unique situation.

Whether you have questions about taxes, investments property, pensions, or savings, Money Tipps has you covered.

Our goal is to educate and empower better investing, so you can achieve your financial goals and live the life you've always wanted.

So why wait?

Start exploring Money Tipps Blog today and take the first step toward a brighter financial future.

Unlock the Secrets of Warren Buffett's Investing Strategy and Build Your Wealth Today: Expert Money Tips on Investing and Personal Finance

Are you ready to start building your wealth and securing your financial future?

Look no further than Warren Buffett, one of the most successful investors of all time.

With a net worth of $109.3 billion, Buffett's investing strategy has stood the test of time, generating consistent returns and building his wealth over the years.

Buffett's first investment was in a pinball machine business, which he purchased for $25.

He placed the machine in a barbershop and soon found himself making a profit of $4 per week.

From this small investment, Buffett learned the power of patience and long-term thinking, which would serve him well in his future investments.

From Penny Pinching to Prosperity: How Investing £10,000 Can Change Your Life Forever. How to Invest £10,000

From Penny Pinching to Prosperity: How Investing £10,000 Can Change Your Life Forever. How to Invest £10,000.

Investing is an excellent way to grow your wealth over time. However, it can be overwhelming to know where to begin, especially if you're just starting. Investing £10,000 is a good start, and it's important to have a plan before you start investing.

In this article, we'll explore how to invest £10,000, the benefits of investing, and what you need to do before investing.

Investing for a Better World: How Ethical Investing Can Create Positive Change and Profitable Returns

Investing for a Better World: How Ethical Investing Can Create Positive Change and Profitable Returns.

Earth Day has just passed, and with it came a powerful reminder of the importance of protecting our planet. More people than ever before are realizing that we all need to be the change we want to see in the world. We can protest, write letters to our MPs, spend our money more consciously, and invest in companies that do good rather than companies that do bad and harm the planet through their business activities and don’t tidy up their mess.

In this blog post I explain how

Unleash your Financial Potential and achieve Money Confidence with Money Tipps®

Are you struggling to save or build wealth, and wondering what habits you should form to create lasting wealth for you and your family?

If so, then you're in luck, because I have personally worked with hundreds of people with their money over the past 5 years since starting Money Tipps® money coaching and as a former FCA-regulated Financial Adviser, and I've discovered some key habits and mindsets that successful wealthy people share.

Find out what they are and 9 habits that can help you create generational wealth:

Click the link and read the newsletter NOW!

Becoming Financially Confident: Lessons from the Fable of the Ant and the Grasshopper

Are you an ant or a grasshopper when it comes to your personal finances?

As the famous fable goes, the ant works hard all summer to store food for the winter, while the grasshopper spends his time singing and dancing.

When winter comes, the ant has plenty of food to survive, while the grasshopper is left hungry and cold.

While the story may seem like a simple children's tale, it holds an important lesson for all of us when it comes to managing our personal finances.

Just like the ant, we need to work hard and save our money to ensure that we have enough to meet our needs in the future.

9 Habits of Wealthy People: Lessons from a Former Financial Adviser

9 Habits of Wealthy People: Lessons from a Former Financial Adviser

Do you ever wonder what sets wealthy people apart from others?

If you are struggling to save or build wealth then here are 9 habits to form to create lasting wealth for you and your family.

I have personally worked with 100s of people with their money over 5 years since starting Money Tipps® money coaching and as an FCA-regulated Financial adviser.

These mindsets and habits are how wealthy people create generational wealth.

How to Invest when investing £20,000

How to Invest when Investing £20,000

How to Invest when investing for investing £20,000 over a 20-year period would be to consider a diversified portfolio of low-cost index funds.

consider a long-term investment strategy that aligns with your risk tolerance and financial goals. Here are a few investment options to consider:

Stocks and Shares ISA: Consider investing in a Stocks and Shares ISA, which allows you to invest up to £20,000 per year tax-free. You can choose to invest in individual stocks, exchange-traded funds (ETFs), or mutual funds based on your risk tolerance and financial goals.

Exchange-Traded Funds (ETFs): ETFs are a type of investment fund that holds a basket of assets such as stocks, bonds, and commodities. They provide diversification and lower fees compared to mutual funds. You can choose to invest in a broad market ETF or one that focuses on a specific sector or theme.

for investing £20,000 over a 20-year period would be to consider a diversified portfolio of low-cost index funds.

7 Reasons Why Investing in a Money Coach is the Best Financial Decision You'll Make in 2023

What exactly is a money coach, and how is it different from other financial professionals like financial advisers and accountants? A money coach is a personal finance expert who works with individuals to help them develop a comprehensive plan for managing their money and achieving their financial goals. Unlike financial advisers and accountants, a money coach focuses on teaching you the skills you need to succeed in managing your finances

Mastering Success: 5 Habits of Highly Successful Millennial Entrepreneurs

The secret to success lies in the habits and mindset of those who have already made it. In this post, we'll explore the 5 habits of highly successful millennial entrepreneurs, how to succeed when working for a start up company or entrepreneur and provide actionable tips on how to stay focused, motivated, and productive

The rise of entrepreneurship among millennials has been nothing short of remarkable. With the internet providing unprecedented access to information and resources, young people are starting businesses and pursuing their dreams at an unprecedented rate. However, with so much competition and noise in the market, it takes more than just a good idea to succeed. In this post, we'll explore the 5 habits of highly successful millennial entrepreneurs, and provide actionable tips on how to stay focused, motivated, and productive.

Spring into Savings: Top 9 Money Saving Tips for Spring 2023

Spring is a time for new beginnings, and what better way to start than by saving money?

In this post, we'll explore the top 10 money saving tips for Spring 2023 in the UK. From shopping smart to reducing energy bills, we've got you covered.

The Bed and ISA, a game-changing approach to managing your finances in the UK. How Can You Benefit From this ISA Strategy?

The Bed and ISA, a game-changing approach to managing your finances in the UK.

Are you tired of your hard-earned savings gathering dust in a low-interest savings account?

Enter the Bed and ISA strategy, the perfect solution to make your money work smarter, not harder

ISAs (Individual Savings Account): The Hen House for Growing Your Investment Nest Egg

ISAs: The Chicken Coop for Growing Your Nest Egg

Imagine you're a farmer raising chickens. You provide them with a safe and comfortable coop, feed them nutritious food, and collect their eggs every day. As time goes by, those eggs start to add up, and you begin to build a nest egg for the future.

Well, ISAs are kind of like that chicken coop, but for your money. They provide a tax-efficient way to save and invest your hard-earned cash, while keeping it protected from taxes and other external threats.

Investment Fees Eating Your Wealth - Why Working with a Money Coach is the Better Option

Did you know that fees can eat away at your investment returns faster than a hungry tiger devours its prey?

Investing can be an excellent way to grow your wealth over time.

However, many people are unaware of the hidden costs associated with investing, which can quickly erode your investment returns.

If you're not careful, fees can reduce your investment and leave you with a lot less than you expected.

The fees charged by financial advisers are one of the biggest culprits when it comes to reducing investment returns.

For example, let's take a look at the leading FTSE 100 financial adviser fees

Tick Tock! 10 Days Left to Invest in Your Future with an ISA - Don't Miss Out on Tax Benefits!

Tick Tock! 10 Days Left to Invest in Your Future with an ISA - Don't Miss Out on Tax Benefits!"

The tax deadline is fast approaching, and if you haven't already invested in an ISA, now is the time to do so. In the UK, the government offers tax benefits for investing in an ISA, making it a smart choice for those looking to save for their future.

Here are just a few of the tax benefits of an ISA just click inside:

Discover the Ultimate Safe Haven Investment: Uncovering the Pros and Cons of Investing in Gold

Gold has been a valuable commodity for thousands of years. It has been used for currency, jewelry, and even as a means of storing wealth. As a geologist, scientist, and commodity trader, I have studied the various factors that affect gold prices, including supply and demand, geopolitical events, and economic cycles. In this blog, I will discuss the positives and negatives of investing in gold and provide evidence-based research on when to invest in gold.

Why Investing is Like a Road Trip (And How to Stay on Track)

Investing can be intimidating, especially for millennials who are just starting their journey in the world of personal finance. The first step to making money is to have a clear goal and a plan to achieve it. He emphasizes the importance of developing a positive mental attitude, perseverance, and a strong work ethic.

However, just like a road trip, investing requires a plan and a roadmap to guide you along the way. That’s why it’s essential to begin with the end in mind.

Slash Your Supermarket Bill: 10 Practical Tips to Save Money on Household Expenses

Saving money on groceries and household expenses doesn't have to be complicated. By following these practical tips, you can significantly reduce your expenses and save money. Remember to plan your meals, shop with a list, look for sales and coupons, buy in bulk, use generic or store brand products, cook at home, grow your own produce, use energy-efficient appliances, make your own cleaning supplies, and reduce waste.

Unlock Financial Freedom with the 50:30:20 Rule: A Simple Guide to Managing Your Money

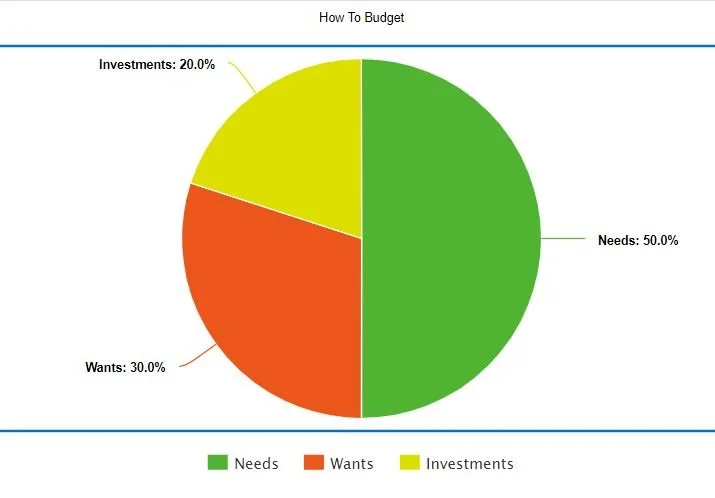

Are you looking for a simple and effective way to manage your finances and achieve your financial goals? Look no further than the 50:30:20 rule!

The 50:30:20 rule is a simple but powerful tool that can help you create sustainable spending habits and take control of your finances. It involves categorizing your spending into needs, wants, and savings, and allocating a specific percentage of your income to each category.

Let's break it down:

50% for Needs: This category includes the basic essentials that you need to live, such as housing, food, utilities, and clothing. These are the expenses that you cannot do without and should always take priority when allocating your funds.

Guide to Finding True Happiness through Personal Finances and Investing

Guide to Finding True Happiness through Personal Finances and Investing. Happiness is something that we all strive for in life. It is a state of being that is elusive and often fleeting. However, what if I told you that true happiness could be found through your personal finances and investing? It may sound counterintuitive, but the truth is that money and happiness are interconnected. When we manage our finances wisely and invest in our future, we can achieve a sense of security, freedom, and peace of mind that can lead to true happiness. In this guide, we will explore the steps you can take to find true happiness through personal finances and investing.

Start your investing journey

Get more money into your pocket, more time in your day and more joy in your life.

Start your financial plan with a money coach by picking one of the four levels of service Money Tipps offer. Click below to get start your journey to financial independence