Blog

Money Tipps Blog

Looking for a way to invest smarter and save big money from not paying financial advisor fees? Looking for the best money tips, Financial tips, saving tips, or investing tips?

Look no further than Money Tipps Blog, the ultimate resource for millennials who want to take control of their finances and build a brighter financial future.

With Money Tipps, you can become your own financial advisor by learning and educating yourself about the ins and outs of investing rather than needing a financial adviser, we give you the tools to educate and empower your own financial knowledge.

Our expert team provides valuable tips, tricks, and teachings to help you get more from your money.

But that's not all - we also offer the guidance of a dedicated money coach, who can help you navigate difficult financial decisions and gain the confidence to make the best investment choices for your unique situation.

Whether you have questions about taxes, investments property, pensions, or savings, Money Tipps has you covered.

Our goal is to educate and empower better investing, so you can achieve your financial goals and live the life you've always wanted.

So why wait?

Start exploring Money Tipps Blog today and take the first step toward a brighter financial future.

7 Reasons Why Investing in a Money Coach is the Best Financial Decision You'll Make in 2023

What exactly is a money coach, and how is it different from other financial professionals like financial advisers and accountants? A money coach is a personal finance expert who works with individuals to help them develop a comprehensive plan for managing their money and achieving their financial goals. Unlike financial advisers and accountants, a money coach focuses on teaching you the skills you need to succeed in managing your finances

Mastering Success: 5 Habits of Highly Successful Millennial Entrepreneurs

The secret to success lies in the habits and mindset of those who have already made it. In this post, we'll explore the 5 habits of highly successful millennial entrepreneurs, how to succeed when working for a start up company or entrepreneur and provide actionable tips on how to stay focused, motivated, and productive

The rise of entrepreneurship among millennials has been nothing short of remarkable. With the internet providing unprecedented access to information and resources, young people are starting businesses and pursuing their dreams at an unprecedented rate. However, with so much competition and noise in the market, it takes more than just a good idea to succeed. In this post, we'll explore the 5 habits of highly successful millennial entrepreneurs, and provide actionable tips on how to stay focused, motivated, and productive.

Spring into Savings: Top 9 Money Saving Tips for Spring 2023

Spring is a time for new beginnings, and what better way to start than by saving money?

In this post, we'll explore the top 10 money saving tips for Spring 2023 in the UK. From shopping smart to reducing energy bills, we've got you covered.

The Bed and ISA, a game-changing approach to managing your finances in the UK. How Can You Benefit From this ISA Strategy?

The Bed and ISA, a game-changing approach to managing your finances in the UK.

Are you tired of your hard-earned savings gathering dust in a low-interest savings account?

Enter the Bed and ISA strategy, the perfect solution to make your money work smarter, not harder

ISAs (Individual Savings Account): The Hen House for Growing Your Investment Nest Egg

ISAs: The Chicken Coop for Growing Your Nest Egg

Imagine you're a farmer raising chickens. You provide them with a safe and comfortable coop, feed them nutritious food, and collect their eggs every day. As time goes by, those eggs start to add up, and you begin to build a nest egg for the future.

Well, ISAs are kind of like that chicken coop, but for your money. They provide a tax-efficient way to save and invest your hard-earned cash, while keeping it protected from taxes and other external threats.

Investment Fees Eating Your Wealth - Why Working with a Money Coach is the Better Option

Did you know that fees can eat away at your investment returns faster than a hungry tiger devours its prey?

Investing can be an excellent way to grow your wealth over time.

However, many people are unaware of the hidden costs associated with investing, which can quickly erode your investment returns.

If you're not careful, fees can reduce your investment and leave you with a lot less than you expected.

The fees charged by financial advisers are one of the biggest culprits when it comes to reducing investment returns.

For example, let's take a look at the leading FTSE 100 financial adviser fees

Tick Tock! 10 Days Left to Invest in Your Future with an ISA - Don't Miss Out on Tax Benefits!

Tick Tock! 10 Days Left to Invest in Your Future with an ISA - Don't Miss Out on Tax Benefits!"

The tax deadline is fast approaching, and if you haven't already invested in an ISA, now is the time to do so. In the UK, the government offers tax benefits for investing in an ISA, making it a smart choice for those looking to save for their future.

Here are just a few of the tax benefits of an ISA just click inside:

Discover the Ultimate Safe Haven Investment: Uncovering the Pros and Cons of Investing in Gold

Gold has been a valuable commodity for thousands of years. It has been used for currency, jewelry, and even as a means of storing wealth. As a geologist, scientist, and commodity trader, I have studied the various factors that affect gold prices, including supply and demand, geopolitical events, and economic cycles. In this blog, I will discuss the positives and negatives of investing in gold and provide evidence-based research on when to invest in gold.

Why Investing is Like a Road Trip (And How to Stay on Track)

Investing can be intimidating, especially for millennials who are just starting their journey in the world of personal finance. The first step to making money is to have a clear goal and a plan to achieve it. He emphasizes the importance of developing a positive mental attitude, perseverance, and a strong work ethic.

However, just like a road trip, investing requires a plan and a roadmap to guide you along the way. That’s why it’s essential to begin with the end in mind.

Slash Your Supermarket Bill: 10 Practical Tips to Save Money on Household Expenses

Saving money on groceries and household expenses doesn't have to be complicated. By following these practical tips, you can significantly reduce your expenses and save money. Remember to plan your meals, shop with a list, look for sales and coupons, buy in bulk, use generic or store brand products, cook at home, grow your own produce, use energy-efficient appliances, make your own cleaning supplies, and reduce waste.

Unlock Financial Freedom with the 50:30:20 Rule: A Simple Guide to Managing Your Money

Are you looking for a simple and effective way to manage your finances and achieve your financial goals? Look no further than the 50:30:20 rule!

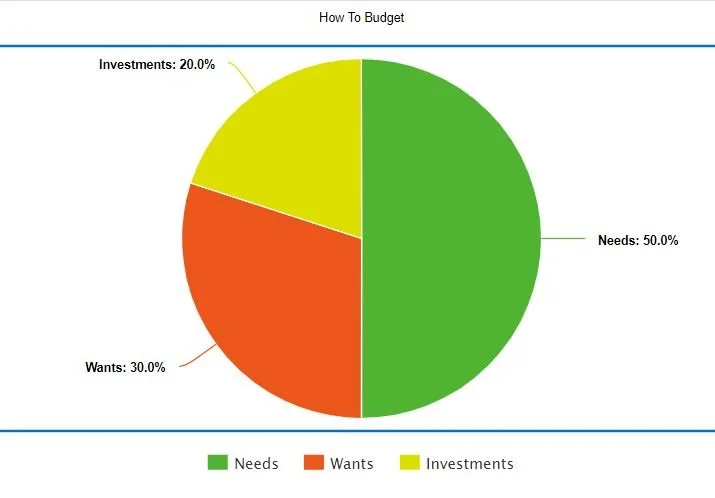

The 50:30:20 rule is a simple but powerful tool that can help you create sustainable spending habits and take control of your finances. It involves categorizing your spending into needs, wants, and savings, and allocating a specific percentage of your income to each category.

Let's break it down:

50% for Needs: This category includes the basic essentials that you need to live, such as housing, food, utilities, and clothing. These are the expenses that you cannot do without and should always take priority when allocating your funds.

Guide to Finding True Happiness through Personal Finances and Investing

Guide to Finding True Happiness through Personal Finances and Investing. Happiness is something that we all strive for in life. It is a state of being that is elusive and often fleeting. However, what if I told you that true happiness could be found through your personal finances and investing? It may sound counterintuitive, but the truth is that money and happiness are interconnected. When we manage our finances wisely and invest in our future, we can achieve a sense of security, freedom, and peace of mind that can lead to true happiness. In this guide, we will explore the steps you can take to find true happiness through personal finances and investing.

Master Your Money: The Top 5 Personal Finance Books You Need to Read

Unlock the Secrets of Financial Independence with Millennial Money Mindset!

his transformative guide is the answer to all your money woes, especially if you're a millennial looking to secure a better financial future.

Written by the author Neil Doig, who's been there, done that and wants to share their wisdom with you, this book is your ticket to financial freedom.

Say goodbye to expensive advice fees, endless stress, and endless worry about money and hello to a life of purpose and progress.

10 Expert Money Tips for Saving, Spending, and Investing Like a Pro

10 Expert Money Tips for Saving, Spending, and Investing Like a Pro

Money management can be challenging, and many people struggle with it. But with the right mindset and strategies, anyone can become an expert in personal finance. Whether you want to save for retirement, pay off debt, or build wealth, these ten money tips can help you achieve your financial goals.

Top 10 Simple and Effective Tips to Save Money

10 simple and effective tips to save money. How to Save Money, reduce stress, and build a more secure financial future. Remember, every little bit counts, and small changes can make a big difference over time. Learn how to save, spend, and invest better with Money Tipp 10-simple-and-effective-tips-to-save-money

How a Money Coach Can Help You Win the Fight for Financial Success

Have you ever watched a boxing match and wondered why the fighters have coaches in their corners? After all, these are professional athletes who have been training for years, so why do they need someone to tell them what to do? The truth is, even the best boxers in the world need guidance and support to help them develop a winning strategy and stay focused in the ring.

A money coach is like a boxing coach for your finances. They provide you with the knowledge, guidance, and motivation you need to succeed. Just like a boxing coach, a money coach can help you see the bigger picture, understand your financial goals, and develop a personalized strategy to achieve them.

5 Money Challenges UK Millennials Face - And How a Money Coach Can Help

5 Money Challenges UK Millennials Face - And How a Money Coach Can Help

Written By Millennial Money Mindset

5 Money Challenges UK Millennials Face - And How a Money Coach Can Help

Struggling with Money? Here's Why a Money Coach is the Answer for UK Millennials.

In this personal finance and education blog we are going to discuss the Top 5 Financial Challenges Facing UK Millennials - And How to Overcome Them with a Money Coach

As a millennial living in the UK, managing your money and making smart financial decisions can be a daunting task. Between student loan debt, an uncertain job market, and a high cost of living

Millennial Money Mindset® Summary

Unlock the Secrets of Financial Independence with Millennial Money Mindset!

his transformative guide is the answer to all your money woes, especially if you're a millennial looking to secure a better financial future.

Written by the author Neil Doig, who's been there, done that and wants to share their wisdom with you, this book is your ticket to financial freedom.

Say goodbye to expensive advice fees, endless stress, and endless worry about money and hello to a life of purpose and progress.

Are you tired of seeing your savings disappear before your eyes due to increasing inflation as the cost of living increases?

Do you struggle with investing your money, scared of losing it all?

Don't worry, you're not alone. Millennial Money Mindset: If You Want The Fruits You Need the Roots was created to simplify the complex world of personal finance and investing.

What is The Millennial Money Mindset in 2023

Millennial Money Mindset refers to the financial attitudes and behaviors of people belonging to the Millennial generation and is characterized by a focus on financial literacy, smart money management, and long-term planning for financial stability and security. This mindset is reflected in the personal finance and investing choices of millennials, who are known for their emphasis on paying off debt, building up their savings, and investing in their future financial security.

Start your investing journey

Get more money into your pocket, more time in your day and more joy in your life.

Start your financial plan with a money coach by picking one of the four levels of service Money Tipps offer. Click below to get start your journey to financial independence